Bond ladder calculator

The number of bonds in the portfolio can be derived by dividing the total dollar amount by the total number of years for which the ladder strategy has to be created. The Fidelity Bond Ladder Tool can help you build a portfolio of bonds with staggered maturity dates in an effort to provide you with a consistent income stream.

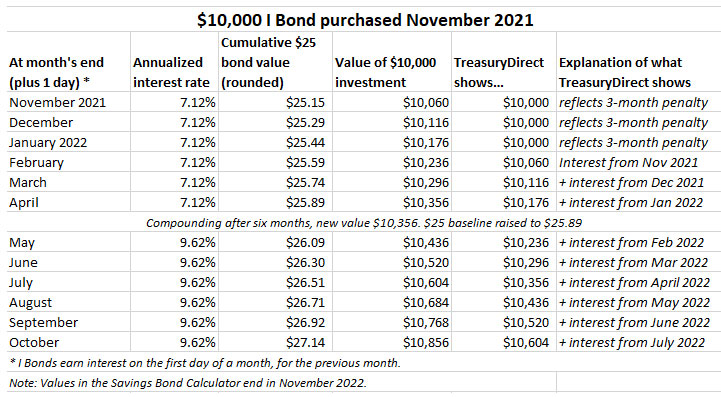

Individual Savings Bond Calculator Inventory Instructions

EE E I and savings notes.

. Build Your Future With a Firm that has 85 Years of Investment Experience. Do Your Investments Align with Your Goals. Likewise you know exactly how much money you should receive in.

Select the Fidelity account in which you want to build your Model CD ladder and enter the total amount you want to invest. This breakdown is provided by BlackRock and takes the median rating of the three agencies when all three agencies rate a security the lower of the two ratings if only two agencies rate a. The Savings Bond Calculator WILL.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. A CD ladder is your best option for a savings portfolio that will.

Build Your Future With a Firm that has 85 Years of Investment Experience. Since laddering requires you buy several bonds at once and most bonds are issues in denominations of 1000 they. Using the bond ladder tool.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. The annual total return of the laddered portfolio is calculated by adding the average annual coupon income from each bond and the weighted average of the change in price of each bond. The Calculator will price paper bonds of these series.

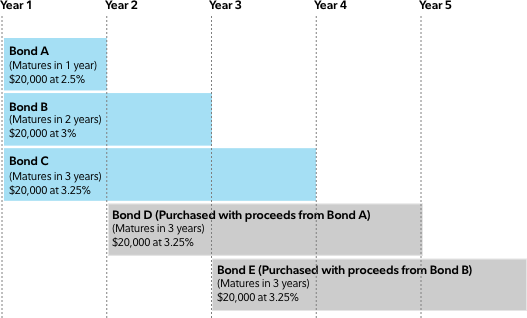

A bond ladder is a portfolio of individual CDs or bonds that mature on different dates. Find a Dedicated Financial Advisor Now. 1-year 2-year or 5-year.

Bond ladders work best with a large upfront investment. Calculate the value of a paper bond based on the series denomination and issue date entered. A while ago I created a little toolkit to design my own bond andor CD ladder.

This strategy is designed to provide current income while minimizing exposure to interest rate. Choose a Model CD Ladder. You can easily calculate your income on those two dates by adding up all of your expected cash flows for each bond.

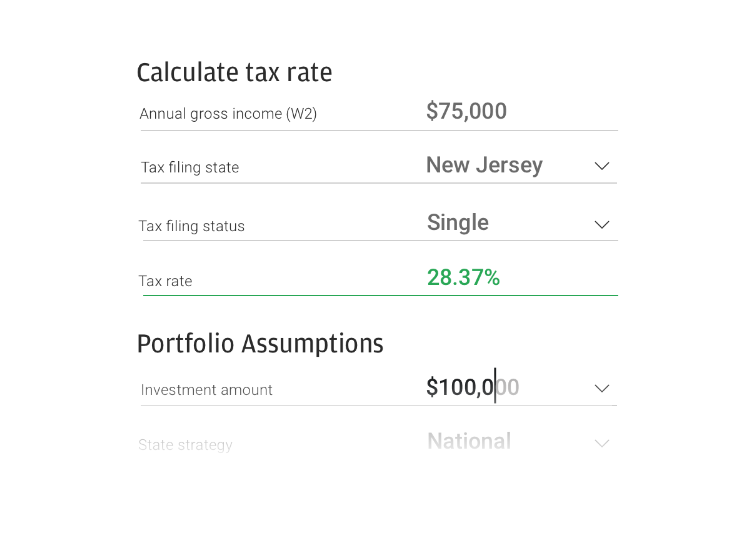

This calculator is designed to help you explore how laddered municipal and corporate bond portfolios may perform in different interest rate environments. CD Ladder Calculator A CD ladder is made up of CDs with staggered maturity dates and is intended to maximize returns. To calculate a value you dont need to enter a serial.

Other features include current interest rate next accrual date final maturity date and year-to. For laddered municipal bond. For more information click the instructions link on this page.

With a bondCD ladder by the way I mean holding a portfolio of bonds andor CDs so the cash flows. Feel free to change the default values below. Then click the calculate button to see how your savings add up.

1

Bond Ladder Tool From Fidelity

Laddered Investing Interest Rate Scenario Tool Eaton Vance

Bond Ladder Illustrator J P Morgan Asset Management

Zs5yd09rzocxim

Bail Bond Calculator Instructions On How It Works Bail Bondsman Bail Instruction

1

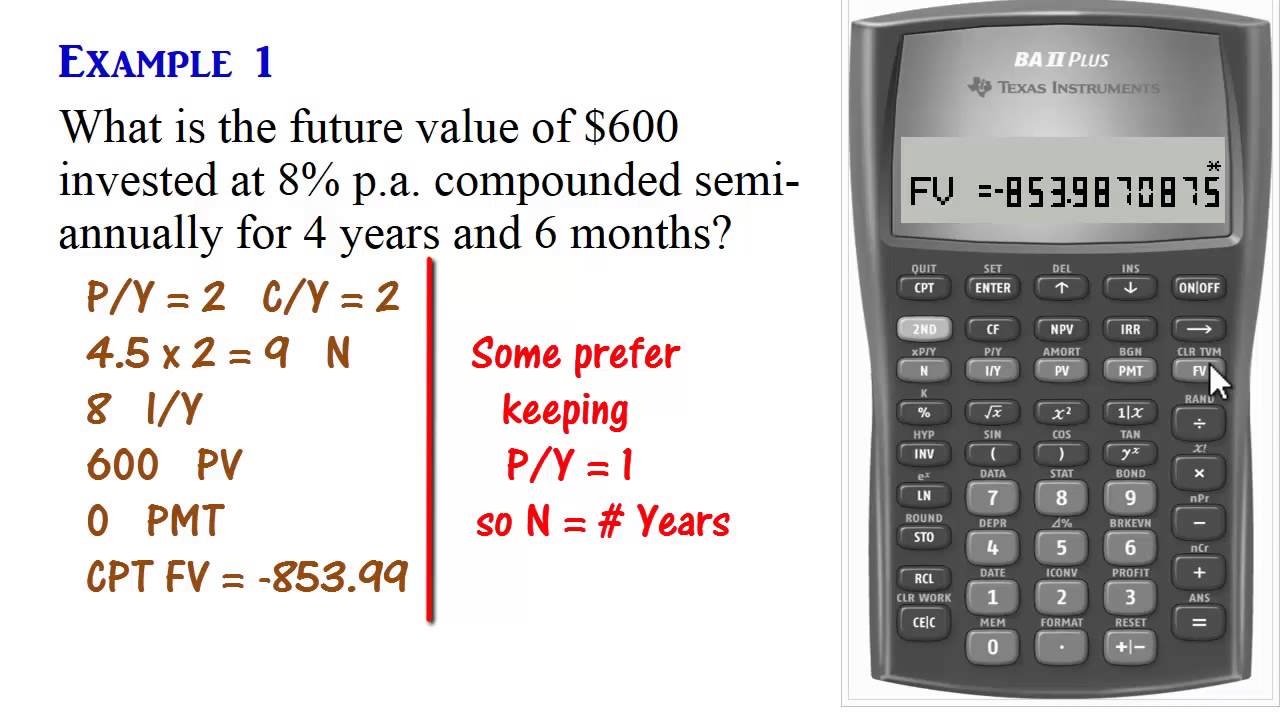

Ba Ii Plus Calculator Compound Interest Present Future Values Youtube

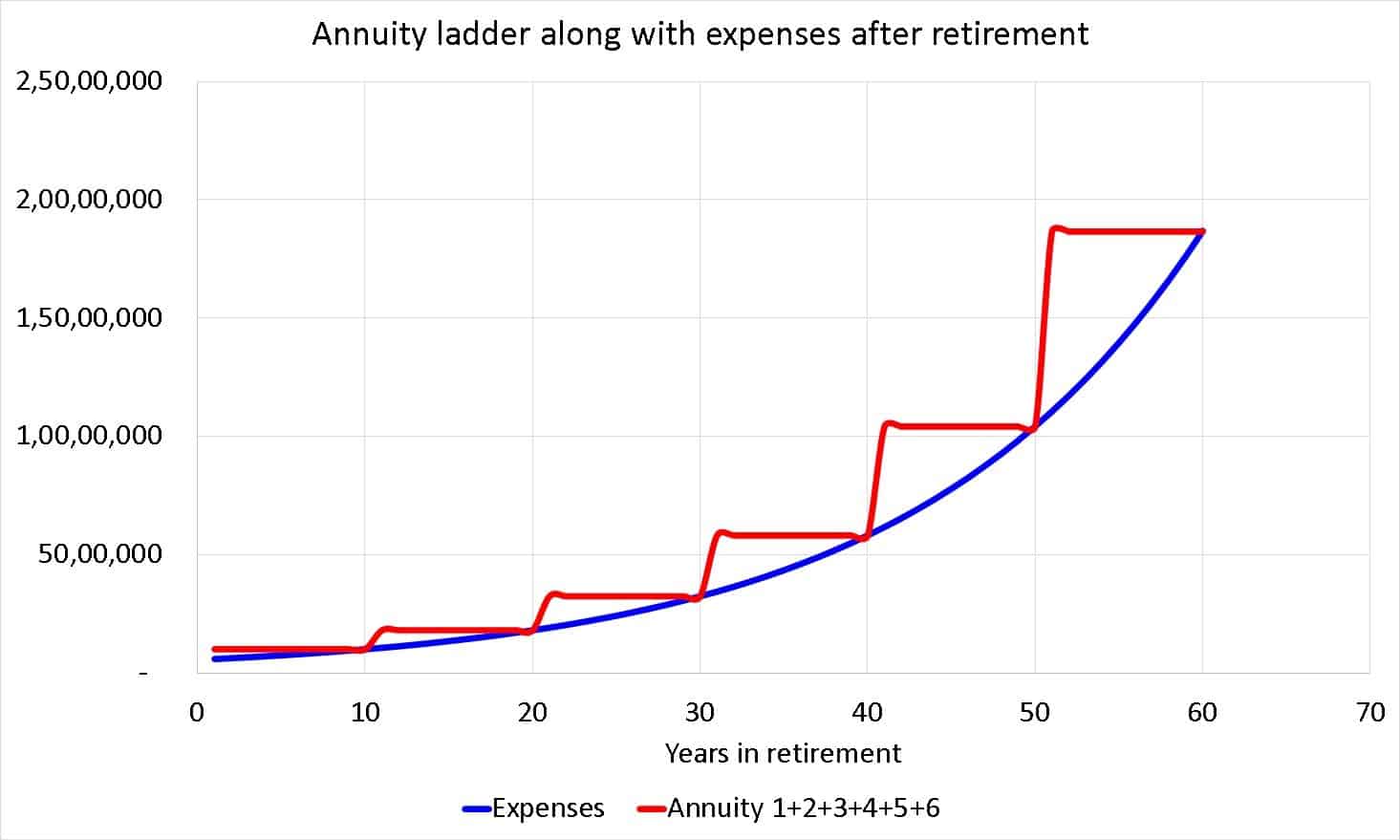

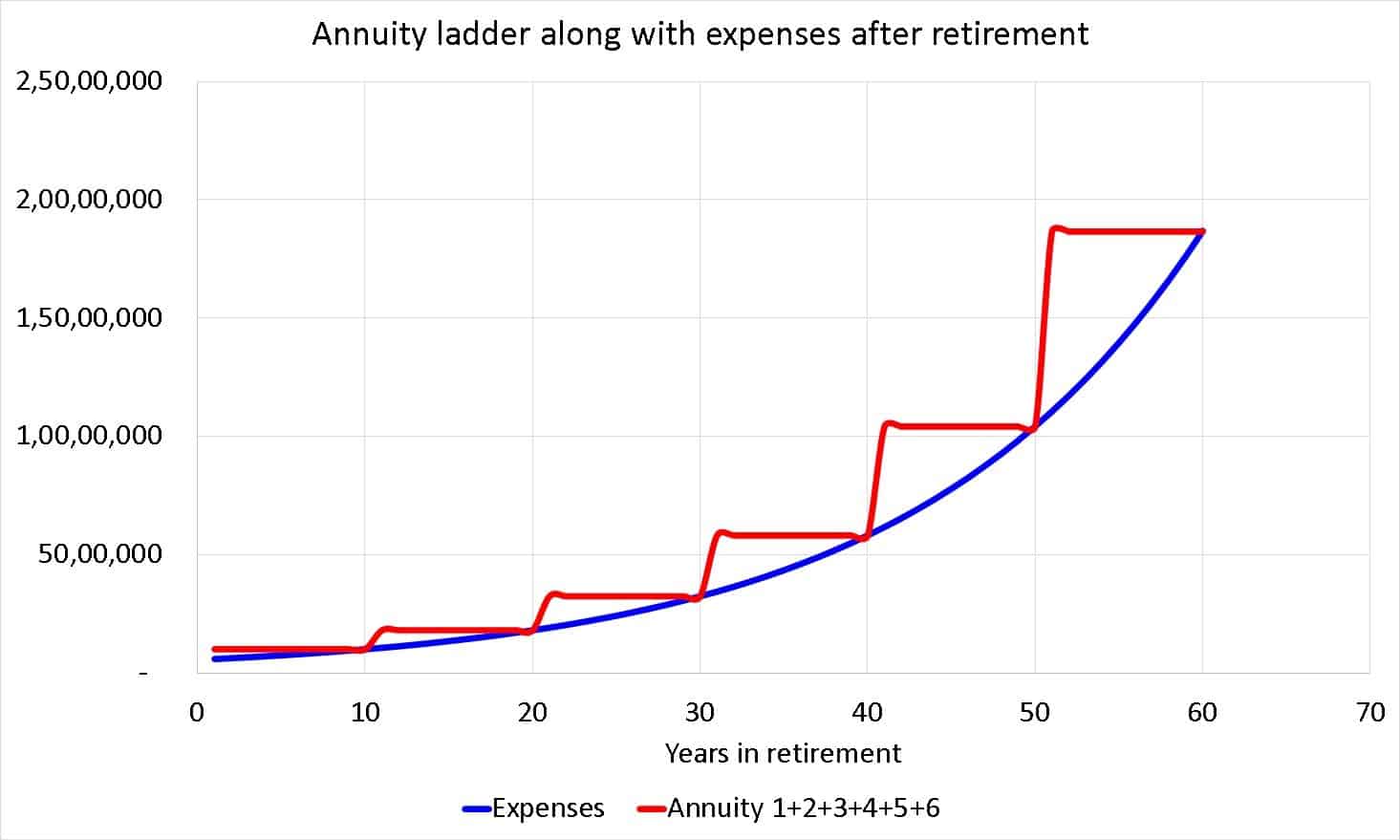

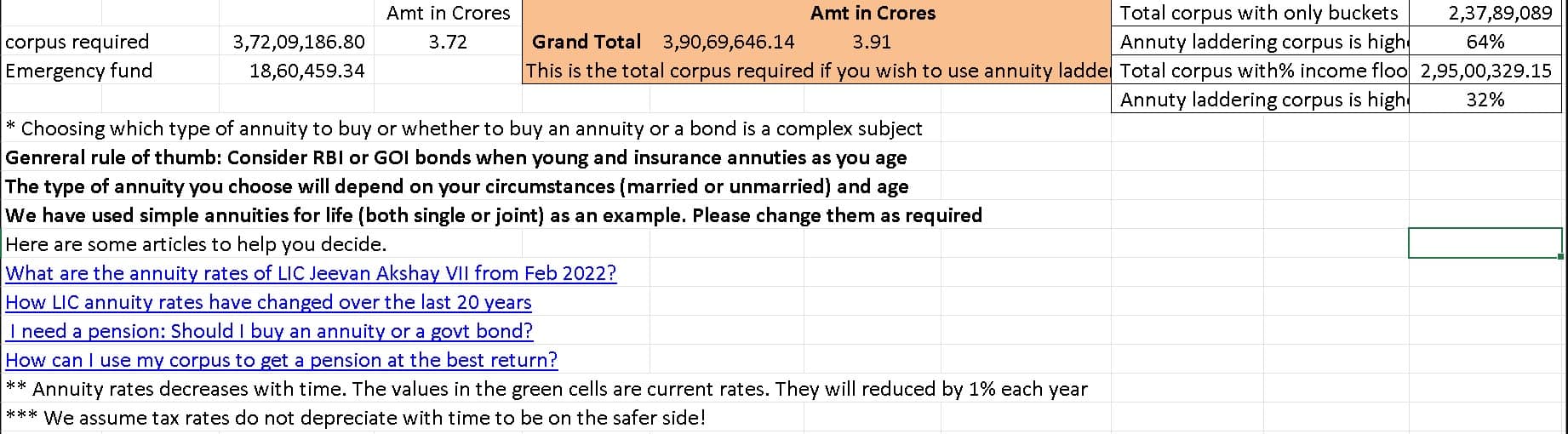

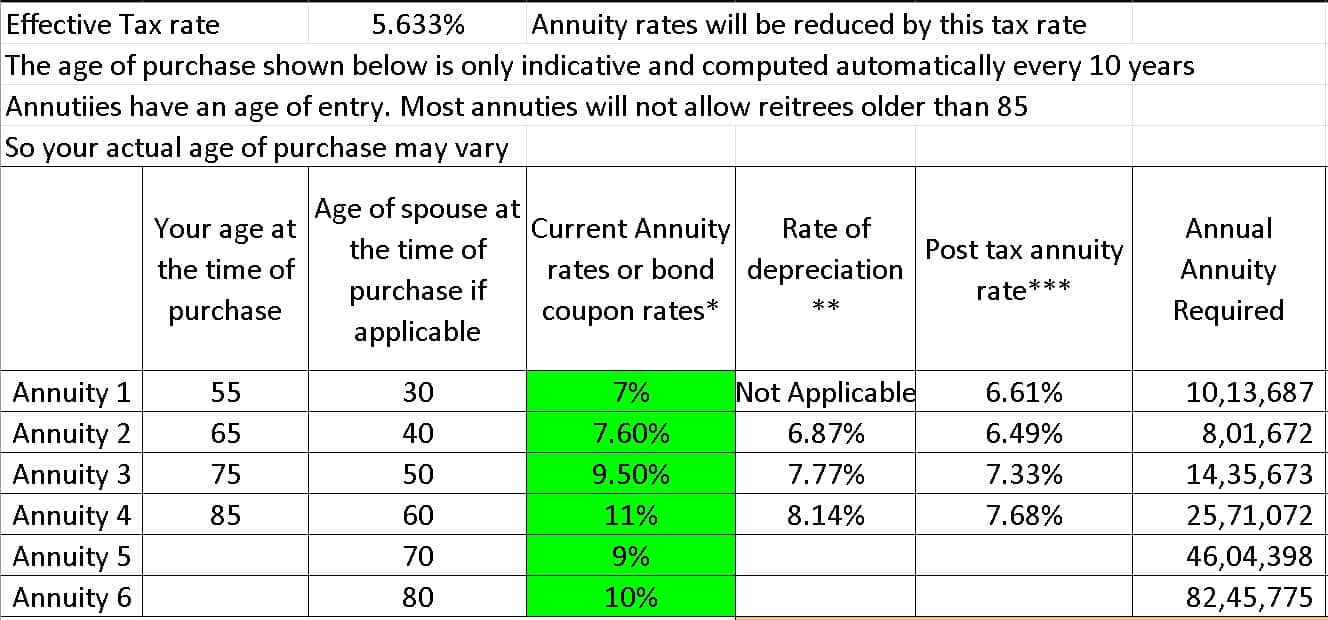

Use This Annuity Ladder Calculator To Plan For Retirement

1

Bond Yield Formula And Calculator Excel Template

Bond Yield Formula And Calculator Excel Template

Municipal Bond Ladder Calculator Tools Nuveen

Use This Annuity Ladder Calculator To Plan For Retirement

Use This Annuity Ladder Calculator To Plan For Retirement

Classic Core 4 Portfolio Core 4 Portfolio Meaning Corporate Bonds Commercial Real Estate Marketing

Rich Broke Or Dead Post Retirement Fire Calculator Visualizing Early Retirement Success And Longevity Risk Engaging Data