Fixed payment loan formula

Consider an adjustable-rate mortgage. A Monthly payment amount.

How To Calculate Your Monthly Mortgage Payment Given The Principal Interest Rate Loan Period Youtube

The payment is the same every month.

. Loan amount total principal of the loan stated on the contract Years to payoff term of the loan stated on the contract Annual Interest Rate the fixed APR charged to borrow Extra payment per month how much you plan to pay extra on a monthly basis. The benefit of this loan is not being required to. If you only.

The extra payment calculator allows you to enter the following figures. Formula for calculating a mortgage payment. To use the early payoff mortgage calculator simply enter your original loan amount when you first received the loan along with the date you took out the home loan.

R Periodic interest rate. Then enter the loan term which defaults to 30 years. Loan term in years - most fixed-rate home loans across the United States are scheduled to amortize over 30 years.

If you would like. Comparison rate is calculated on the statutory assumption of 150000 loan over 25 years but the minimum required loan amount is 200000 for the Complete Home Loan Package. Next determine the loan tenure in terms of no.

Formula for a Monthly Loan Payment. See how your payments change over time for your 30-year fixed loan term. The mortgage payment calculation looks.

You enter all your current monthly debt obligations such as car loan payment minimum credit card payments student loan payments etc. The formula for Amortized Loan can be calculated by using the following steps. Mortgage Calculator exe file - click the link and immediately run the mortgage calculator.

Simple interest and amortized loans will generally have the same. Amortization involves paying down a loan with a series of fixed payments. To qualify for the loan your front-end and back-end DTI ratios must be within the 2836 DTI limit calculator factors in homeownership costs together with your other debts.

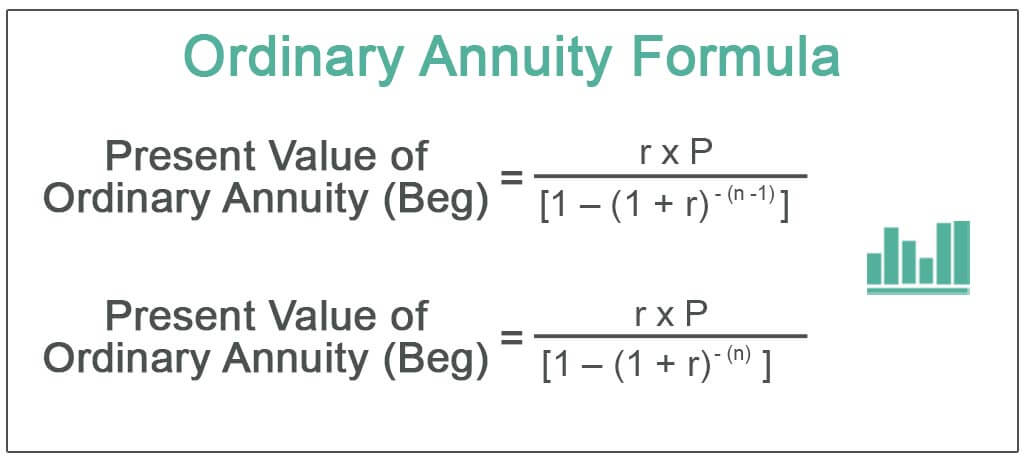

P Loan Principal. An annuity is a series of equal cash flows spaced equally in time. With these inputs the NPER function returns 59996 which is rounded to 60 in the example representing 60.

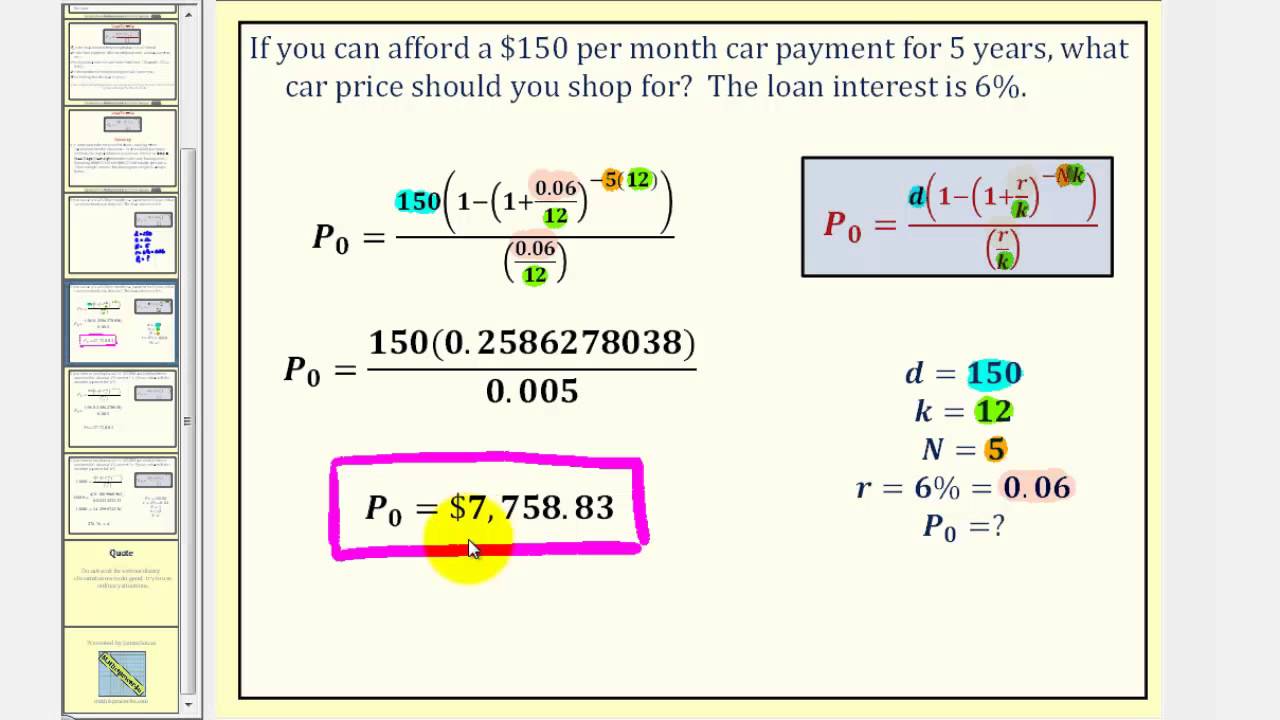

This is the best option if you are in a rush andor only plan on using the calculator today. An example formula would be. To calculate the monthly payment with PMT you must provide an interest rate the number of periods and a present value which is the loan.

The formula for mortgage basically revolves around the fixed monthly payment and the amount of outstanding loan. Use our Car Loan Calculator to check monthly EMI on the basis of car price down payment interest rate loan tenure. See the results below.

You may also enter 360 months for a 30-year loan or 15 years for a 15-year fixed or 180 months depending on loan type desired. Factors such as your income and monthly expenses will aid you in deciding whether taking a loan is a good idea. An EMI equated monthly installment is your monthly mortgage payment on a fixed-interest rate loan ie.

Type - When payments are due where 0 end of period and 1 beginning of period. A 30-year fixed-rate loan will give you the lowest payment compared to other shorter-term loans. For some ARMs the initial rate and payment can vary greatly from the rates and payments later in the loan term.

The PMT function calculates the required payment for an annuity based on fixed periodic payments and a constant interest rate. With 20 down you can eliminate the need for any PMI. The fixed monthly mortgage repayment calculation is based on the annuity formula Annuity Formula An annuity is the series of periodic payments to be received at the beginning of each period or the end of it.

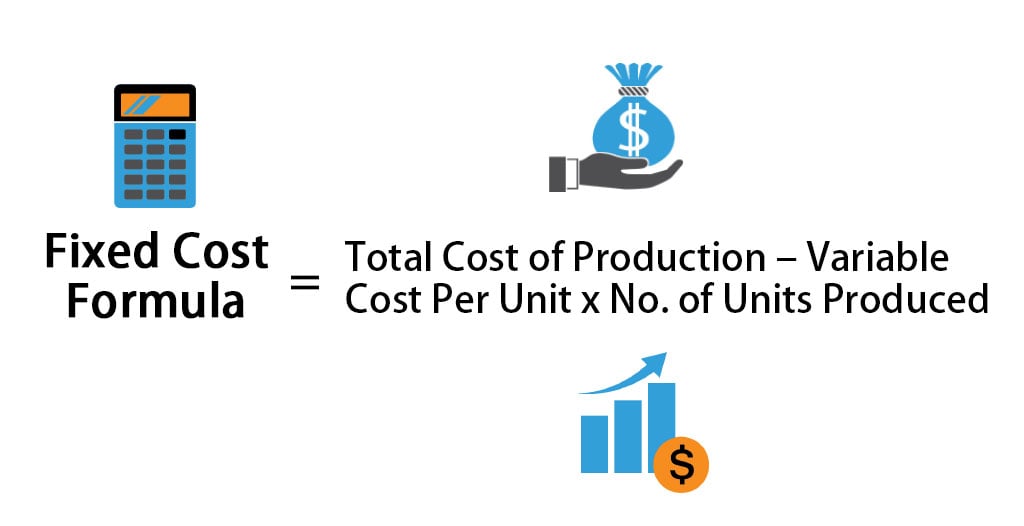

If you fixed your loan at 900 you have one year left on your fixed rate and banks are currently offering rates of 600 then. These payments in addition to your new mortgage cannot exceed the maximum debt-to. It is interpreted mathematically as below Fixed Cost Total Cost of Production Number of Units Produced.

Payments per year - defaults to 12 to calculate the monthly loan payment which amortizes over the specified period of years. As a result payment amounts and the duration of the loan are fixed and the person who is responsible for paying back the loan benefits from a consistent single payment and the ability. Other common domestic loan periods include 10 15 20 years.

Learn more about how it works. The formula does not differ based on what the money is spent on but only when the terms of repayment deviate from a standard fixed amortization. Next figure out the rate of interest to be paid on the loan and it is denoted by r.

35 or even 40 years. The loan payment formula can be used to calculate any type of conventional loan including mortgage consumer and business loans. VA loan - 30-year fixed-rate for qualifying veterans and active military.

FHA 30-year fixed - Best for homebuyers with lower credit scores. Firstly determine the current outstanding amount of the loan which is denoted by P. A mortgage is an example of an annuity.

30 year fixed loan term. Also a great option if you want to put down a smaller down payment. Even if interest rates are stable your rates and payments could change a lot.

Get the best deals on Car Loan at CarDekho. An annuity is based on. An amortization schedule is a complete table of periodic loan payments showing the amount of principal and the amount of interest that comprise each payment until the loan.

Annual real estate taxes. Mortgage Calculator zip file - download the zip file extract it and install it on your computer. By using loan payment calculations you can figure out whether you can realistically afford to borrow money.

The loan is paid off at the end of the term. Fixed the formula in cell F31 that was making the Pie chart double-count the fixed closing costs. The total amount owing on your loan becomes immediately due for payment because you are in default.

With interest-only loans and amortizing loans you can solve for what your monthly payments would look like. Your principal and interest payments will drop with a smaller loan amount and youll reduce your PMI expenses. If lenders or brokers quote the initial rate and payment on a loan ask them for the annual percentage rate APR.

If using excel you can calculate the monthly payment with the following formula. Default is 0 so we do not provide a value. Different rates apply for different loan amounts and may depend on the duration of a fixed rate period or the ratio of the loan amount to the property value.

This can be easily. Formula to calculate Fixed Cost. We can derive the Fixed Cost formula by first multiplying the number of units produced and the variable production cost per unit then subtracting the result from the overall production cost.

A fixed-rate mortgage FRM is a mortgage loan where the interest rate on the note remains the same through the term of the loan as opposed to loans where the interest rate may adjust or float. Break fee Loan amount x Remaining fixed-term x Change in cost of funds. This is the best option if you plan on using the calculator many times over the.

Fv - the future value or desired balance after last payment. We do not provide a value since the default is zero and makes sense for a loan. Of years which is denoted by t.

Make a bigger down payment.

True Mortgage Apr Calculator Actual Interest Rate Home Loan Calculator Loan Calculator Home Loans Interest Rates

Loan Payment Spreadsheet Budget Spreadsheet Spreadsheet Mortgage Amortization Calculator

Interest Only Calculator

Features Of Debentures Words The Borrowers Stock Exchange

Annuity Present Value Pv Formula And Calculator Excel Template

Fixed Cost Formula Calculator Examples With Excel Template

Solve For Remaining Balance Formula With Calculator

Auto Loan Calculator Calculate Car Loan Payments

Ordinary Annuity Formula Step By Step Calculation

The Installment Loan Formula Youtube

Loan Payment Formula With Calculator

Loan Amortization Calculator

Mortgage Calculator How Much Monthly Payments Will Cost

Fixed Charge Coverage Ratio Definition Formula Examples Security Finance Coverage Charging

Loan Payment Schedule Template Amortization Schedule Schedule Template Schedule Templates

Flat Interest Rate Vs Reducing Balance Rate Types Of Loans Interest Rates Interest Calculator

Monthly Payment Formula How To Calculate Loan Payments Video Lesson Transcript Study Com